As part of its second annual Technology Report, Bain & Company published a study yesterday that reframes large acquisitions by tech companies — anything over $300 million — as inconsequential or even beneficial for competition. In an environment of increasing wariness of massive conglomerates, this raised my eyebrows, especially since it was being promoted by the CEO of a tech company lobbying organization.

It is not my place to assess the economics or business acumen of this study. I went to art school, which is sort of an anti-education in those kinds of fields. Usually, I would stay out of this sort of commentary since my reaction probably means that I am missing something non-obvious. But there are several things in this study that, so far as I can tell, do not require an economics degree to see that the conclusions drawn do not match the evidence presented.

The first case study is Amazon’s acquisition of Whole Foods in 2017. Bain produced three graphics. One shows that Whole Foods’ “pricing premium” over standard grocery store chains fell in the two years after Amazon bought the company. That is great, except Bain draws the conclusion that this “[made] healthy, fresh food more affordable for consumers”. That is an absurd summary. Last I checked, regular grocery stores had fresh, healthy food too, and at lower prices than the 13% premium Whole Foods charges, according to Bain’s own chart.

The second and third charts show that there was a modest increase in online grocery purchases between 2015 and 2019, followed by an explosion of the same in 2020. A similar trajectory is shown for delivery, in a graphic comparing 2016 to 2020 and carrying the headline “acquisition intensified pressure to adopt delivery”.

I am wondering if you, reader, can think of anything else beginning in 2020 that may have encouraged many more people to shop for groceries online and have them delivered. Anything at all?

Bain:

Amazon’s 2013 expansion into grocery delivery with Amazon Fresh added pressure on US grocery retailers to begin offering online ordering and delivery services, and that pressure only intensified after Amazon acquired Whole Foods. Now, every major US grocery retailer offers online ordering and delivery services, either managed in-house or via partnerships. This was true even before the Covid-19 pandemic.

I buy the basic thrust of this argument. Amazon is a classic conglomerate, but many of its innovations have been in logistics. It is unsurprising that the biggest online retailer in the U.S. would be able to extend those logistics capabilities to a grocery store, and it is arguably beneficial for consumers, particularly persons with disabilities.

But there are reasons beyond stagnation why supermarkets in the U.S. have been reluctant to embrace delivery. Deliery is dependent on delivery drivers and, without the artificially low pay structure of gig workers, it is prohibitively expensive because of its inherent inefficiencies. But because the gig economy is now a reality, grocery delivery has become a practical option, initiated — if anything — by Instacart, which launched in 2013, months before Amazon’s effort.

The benefits Bain describes can also be attributed to scale. Amazon also offers perks like free shipping in its online store, which small businesses struggle to compete against. Lower prices and free shipping are the kinds of consumer benefit derived from massive scale, but they must be weighed against the benefits of retailer choice and local businesses.

I am getting into the weeds here and away from the point I think we ought to focus on: Bain asserts that Amazon’s acquisition of Whole Foods was a key reason we now have widespread grocery delivery. It seems far more likely to me that grocery delivery was yet another industry where startups could underpay gig workers to do tasks that were previously economically unviable, and Amazon was well-positioned to hop on that ride. Instacart was in an even better place when Amazon bought Whole Foods, since grocery stores saw it as a lesser evil.

Another case study in the Bain report looks at the acquisition of WhatsApp by Facebook. The authors point to the effect this acquisition ostensibly had on SMS prices in the U.S., producing a chart that showed — in two-year increments — the average cost of an SMS.

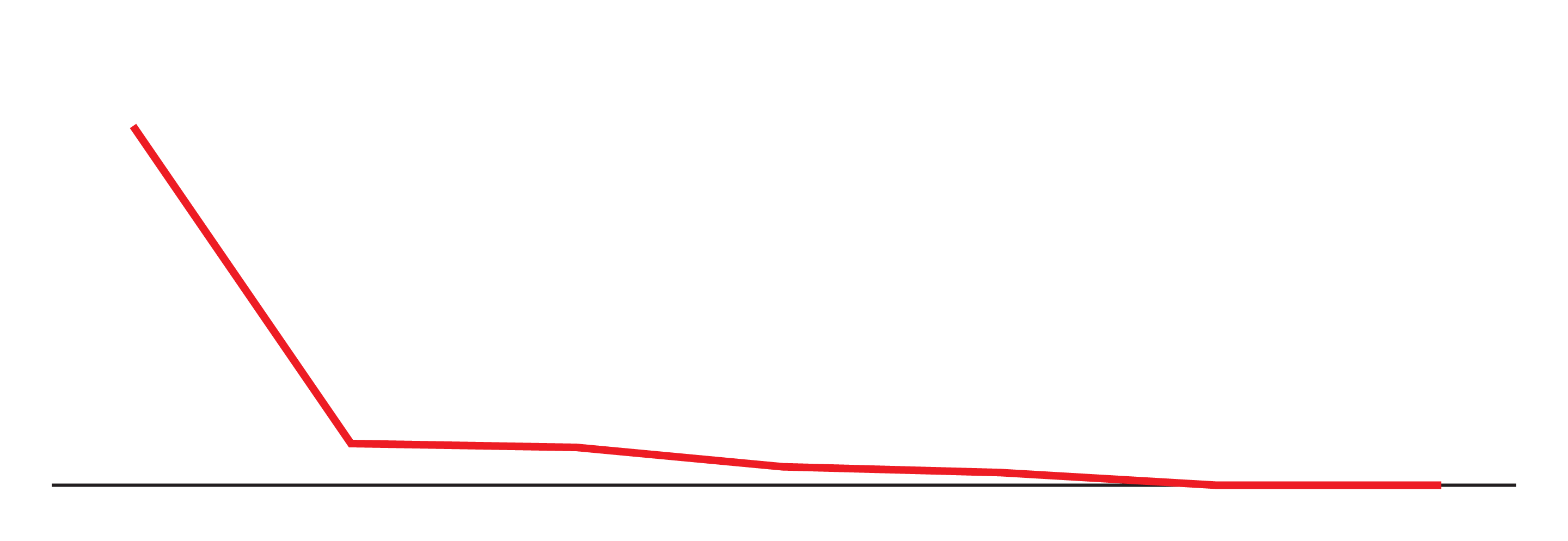

I have reproduced that sole data series here and I would like you to point to the spot on this line of average SMS prices where WhatsApp was acquired:

Is it not obvious?

Here is the full chart they presented:

This chart shows that the biggest drop in SMS costs came before app-based messaging went mainstream, even before iMessage launched in 2011. The price of voice calls also catered around the same time. 2010 was about when carriers realized that charging people for texts was unnecessary since data was the new gravy train.

The story presented in Bain’s series of charts is really the story of switching from a protocol to several platforms. SMS, for all its faults, is a platform-agnostic messaging protocol that requires nothing extra. Now, we have a bunch of messaging applications that compete, but also silo our communications. My conversations span seven different messaging apps, and it is a good thing I am not an Android user or I would be struggling. Is it inherently good that we have many different messaging clients now? I appreciate the many features these platforms provide, but it seems to have come at the expense of interconnectedness. Imagine if we had many different telephone protocols that were platform-specific and incompatible with each other.

One more example from this Bain report is Google’s acquisition of YouTube. Here’s how the authors explain that:

In video streaming, YouTube helped fuel the proliferation of “over the top” (OTT) video providers such as Hulu, Sling, and Disney+. Now, YouTube competes for advertising dollars both with other OTT providers and traditional television companies.

The reason people were not consuming streaming video as much in 2006 — or 2001, when Blockbuster and Enron launched their own streaming service — is not because Google did not own YouTube at that time. Widespread broadband connections are a far more likely reason people are consuming more streaming video now.

More to the point, there simply is not another YouTube. I ran a poll last week — which, with only 43 respondents, is not some kind of robust study — in which I asked Twitter followers how many pre-roll ads YouTube could run before it sees a decline in viewership. 65% thought three pre-rolls was the cap, but I think it could be pushed way higher. If there were suddenly five or six pre-roll ads before the first video you watched that day, and then three or four on subsequent videos, do you really think people would stop watching? Where would they go?

The most robust user-generated video competitor, according to Bain’s charts, is Twitch. The Amazon-owned site is not really a YouTube competitor aside from in specific verticals and, as Ryan said in response to my poll, it is also running several ads before streams. These platforms are both terrible for users, and they know they can be increasingly horrible because they have no replacement.

I can continue to nitpick, but near the end, the study veers from mixing up cause and effect to being almost deceptive (“hyperscalers” is what Bain calls Alphabet, Amazon, Apple, Facebook, and Microsoft):

The common narrative is hyperscalers are acquiring disruptive competitors. But their M&A activity is only a small piece of the overall landscape, representing just 5% of total tech start-up exits last year (see Figure 5).

Switching from the value of acquisitions — which is mostly what the preceding paragraphs are all about — to their quantity masks their impact. Facebook’s acquisition of WhatsApp or Apple’s purchase of Beats is not equal to a small tech company merging with another small tech company. That is an obviously unfair comparison.

The impression I get from this study is that an acquisition by a big company of something else can be a wider indication of the value of that market, hopefully creating competition in that space. But that is not what much of this data shows. There are so many examples here of “hyperscalers” hopping onto an existing market trend that it is hard to see that case being made. The closest the authors get is with Instacart’s boom following Amazon’s purchase of Whole Foods — but “Instacart” appears nowhere in this study.

It is a frustrating article where I am sure I am missing a great deal. I wish I could read the authors’ references or see their analysis in more detail. But all we get is this lightweight summary that does not prove its case.